SA Youth connects young people to work and employers to a pool of entry level talent.

Are you a work-seeker?

November 2018

Young people access financial services at roughly half the rate of adults. This impacts on their ability to grow an asset base, invest in their education, or start a business. Access to affordable financial products and services that meet the needs of young people can provide longer term financial security and bolster chances of sustained economic participation.

Yet, youth often lack the knowledge or experience to use financial services and products effectively

In this edition of Breaking Barriers, we spotlight financial inclusion barriers and solutions, drawing on leading-edge research by Bankable Frontiers Associates (BFA) that tracked the detailed financial flows of young people.

Click here to learn more about BFA’s research with Harambee on Financial Inclusion

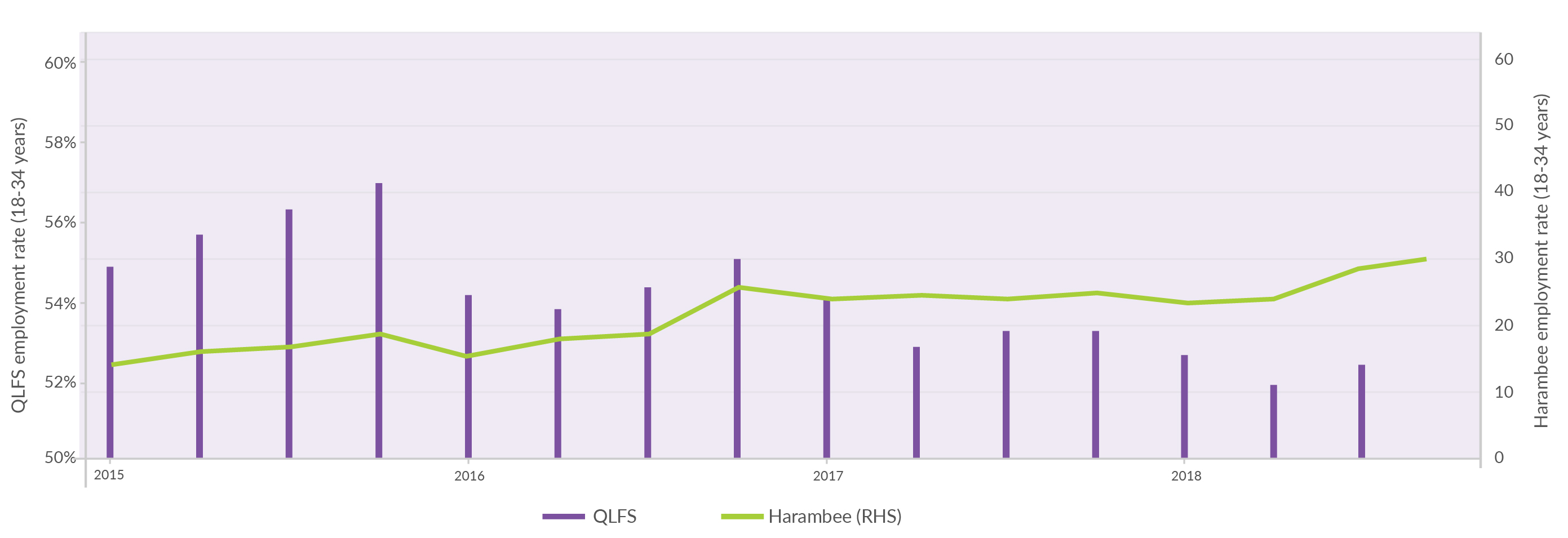

According to the latest Statistics South Africa Quarterly Labour Force Survey (QLFS), the employment rate for youth aged 18 – 34 increased by 0.5 percentage points to 52.3% over the past quarter. The four industries that recorded net new job opportunities for young people are finance and business services; community, social and personal services; manufacturing; and agriculture.

Harambee’s employment rate is lower than that of the Quarterly Labour Force Survey because Harambee reaches excluded youth who tend to face higher structural barriers to employment. Nevertheless Harambee’s increased employment rate of 30.1% tracks the QLFS uptick this quarter. This however is a very modest improvement from the previous quarter and reflects little change in the ability of the labour market to absorb excluded young people.

More worrisome is that while the overall employment rate has increased modestly, this has not been true for young people who are not in employment, education or training (referred to as NEETs). We see that there has been a 0.7 percentage point decrease in employment for NEETs this quarter. A staggering 44.5% of South Africa’s young people now fall into this category of NEETs

INSIGHT 1

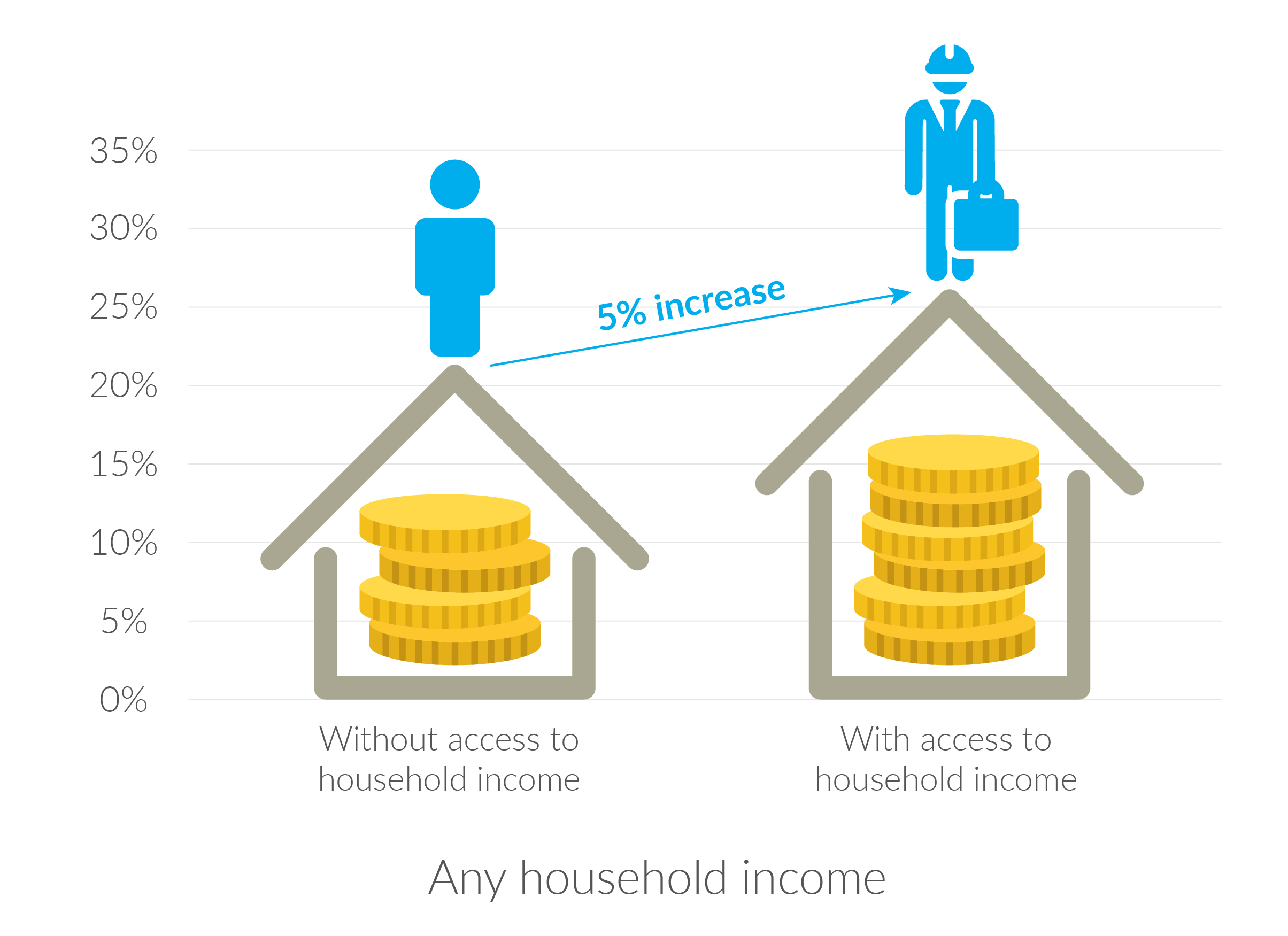

Analysis of Harambee’s own data indicates that having access to some form of finance (whether through the paid work of other household members, government welfare grants, savings or debt) is positively associated with future labour market outcomes.

Individuals are 12 – 25% more likely to work later in their lives if they are from a household that has a positive financial situation. Being in a household with an income source has the largest impact on finding and being in work. Furthermore, access to any household income improves the probability of long-term employment by almost 50% because there is funding for the high costs of work-seeking.

Figure 1: Access to household income and employment outcomes

Source: Harambee data

INSIGHT 2

It is common for black South Africans to support immediate and extended poorer family members. If one has a job, it is seen as a duty to subsidise relatives who are less well off. “Black tax” is a colloquial term for sharing one’s salary with family and making sure that they are well taken care of before considering saving or investing.

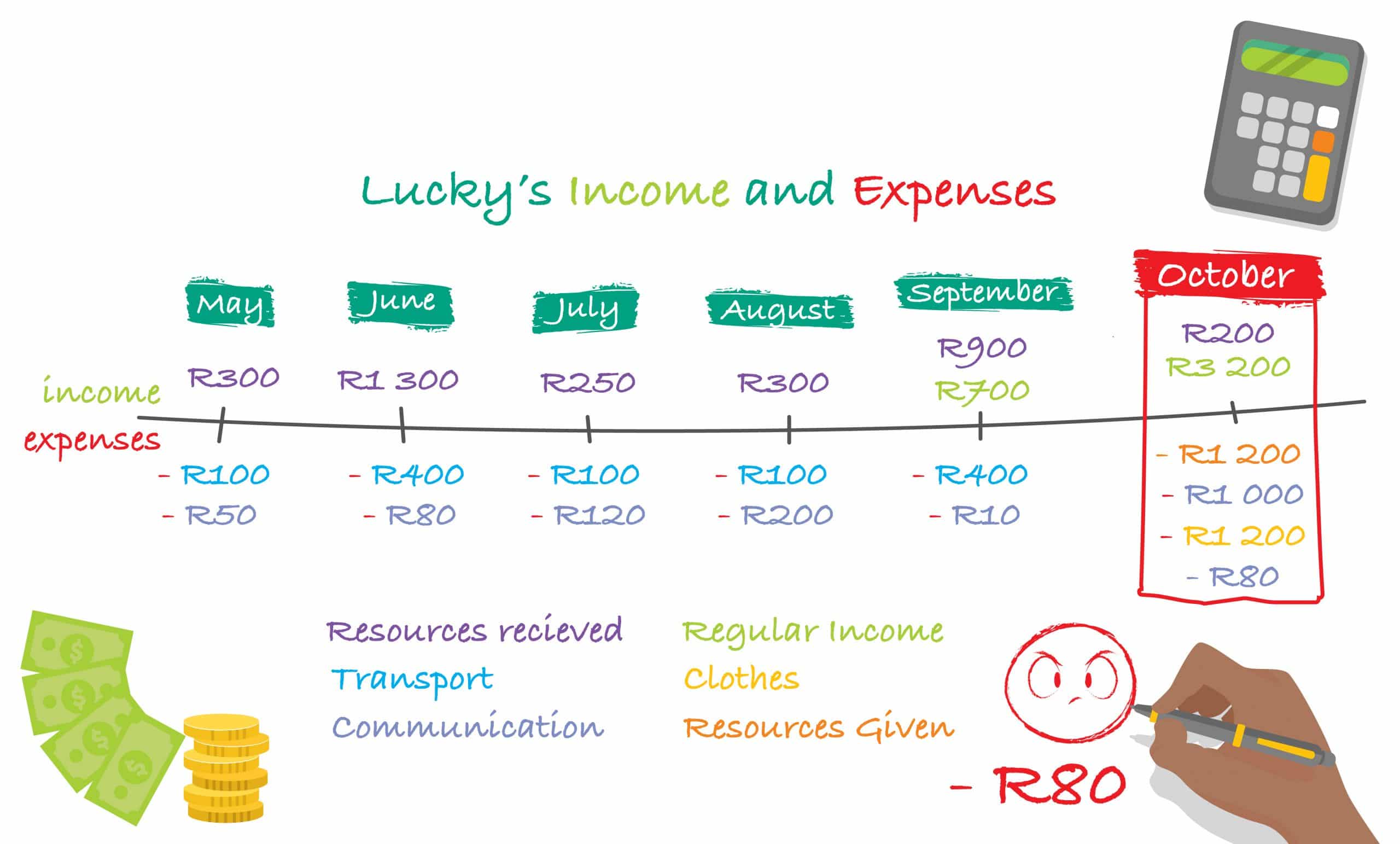

The Bankable Frontiers Associates (BFA) study shows that those regularly employed were expected to give a portion of their monthly salary to others. At the median, this was 8% of take-home pay but more than half the respondents reported the amount was greater than that with at least one respondent reporting that it was between 50 and 60%. 21% of study participants were parents, and 21% were siblings.

Figure 2: Employers value communication, grit and resilience highly

Source: BFA Harambee Research

Mothusi is presently staying with two brothers, a sister, and two of his nieces. His mother passed away in 2011. His father makes a living by selling chicken feet.He started working at Fruit Spot on a three-month contract. Thereafter, he signed a 7-month contract with Baker’s Brothers.

He opened up a clothing account a while ago, and had forgotten about it, until he had to sign a contract against his will – stating that he had to pay R300 a week to this account. He said that this really crippled him, as it is about half of his salary. Furthermore, he received a text message saying that R500 had been withdrawn from his bank account – a transaction that he had not authorized. He rushed to the bank, and after a long argument with them, they agreed to repay him. He also says that his brother is a student at UJ and sometimes makes financial demands which he cannot meet. He has started complaining to other family members about this and has turned everyone against him. “I feel this is very wrong because the reason I am not studying is because my family is struggling. I had to go work to support them”. He is trying to remain optimistic though, and his dream is to become a business owner one day.

Source: Source: BFA Harambee Research

INSIGHT 3

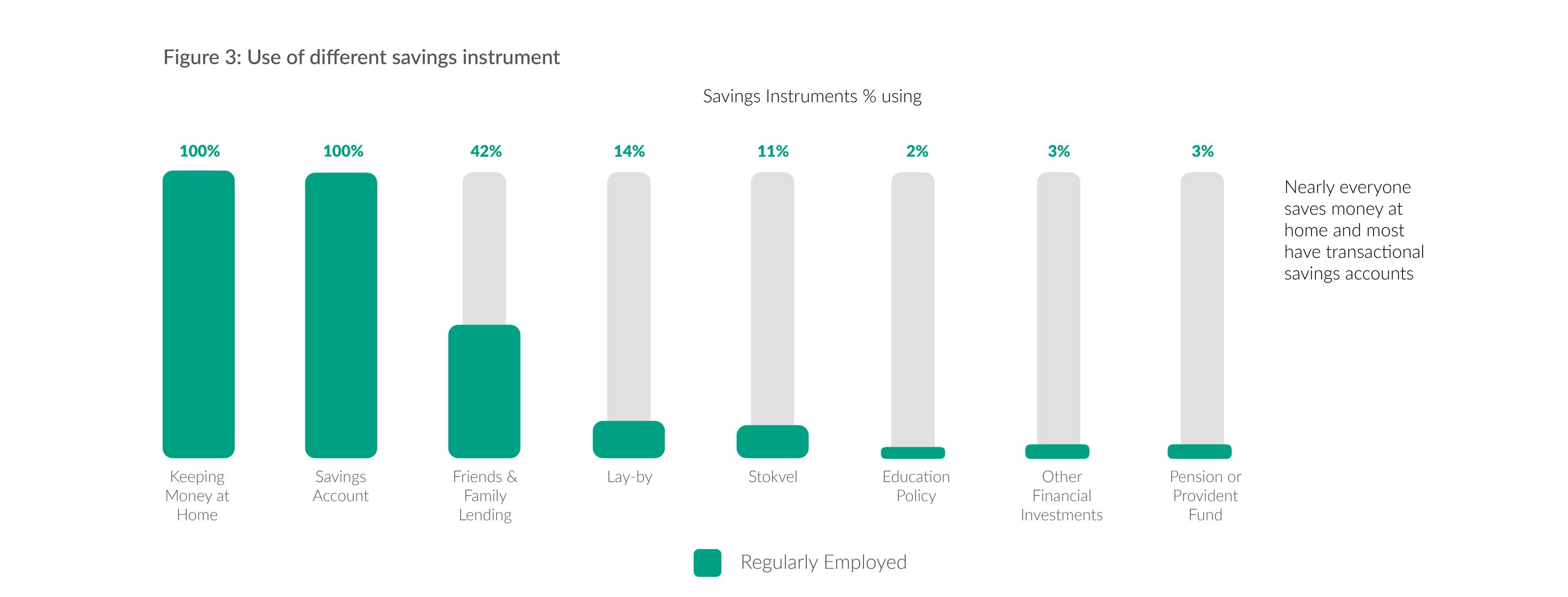

The BFA study showed that young people use few savings instruments and still rely on keeping cash at home. They don’t see wise or widespread use by others around them of credit instruments that could be used to grow wealth, yet their aspirations often require longer term investment (eg, further study, starting a business) which are often at odds with the immediacy and short-termism of their financial behaviours.

Source: Source: BFA Harambee Research