In the nascent impact bonds market, employment is one of the most popular sectors, representing nearly a third of the deals contracted globally. After a year of implementation, the first social impact bond(SIB) in South Africa—the Inclusive Youth Employment Pay for Performance Platform—achieved its target outcomes early, placing 600 young people into jobs. One of the most interesting elements of this deal is the phased approach the project has taken: After a year of testing the SIB structure with a limited number of actors, the project will scale up for the next three years, expanding to multiple service providers, and bringing new investors and an additional outcome funder on board.

WHAT IS THIS IMPACT BOND TRYING TO SOLVE IN SOUTH AFRICA?

In South Africa nearly 40 percent of young people ages 15-34 are not in employment, education, or training (NEET). This statistic also masks a wide gender gap: While 35 percent of young men are NEET, the rate is 43 percent for young women. The majority of unemployed South Africans are those with low or no educational qualifications: Of the 6 million unemployed people in the last quarter of 2018, nearly 60 percent had not graduated from high school.

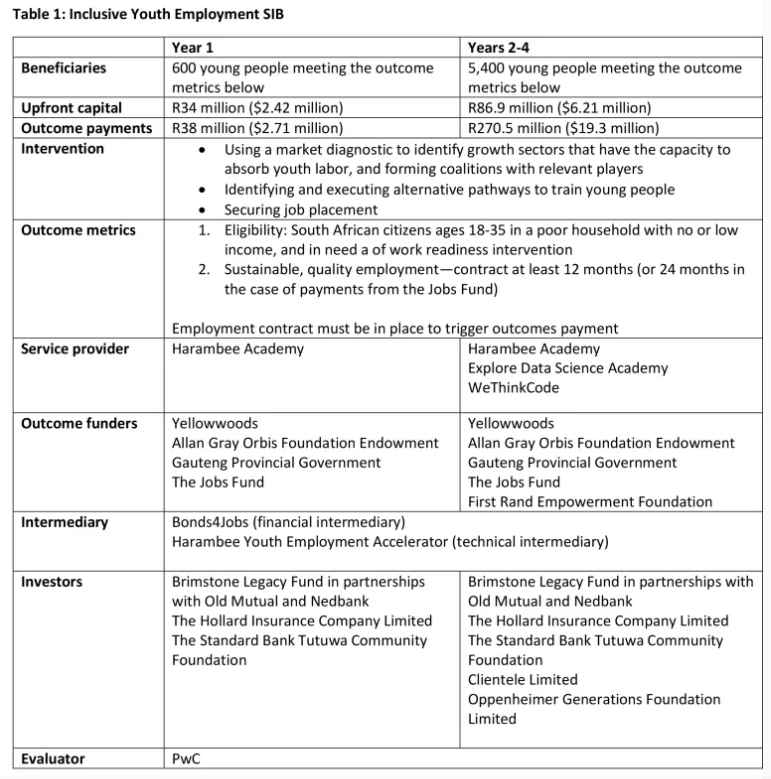

Launched in April 2018, in its first year the SIB provided upfront capital to the service provider Harambee Academy, to identify employment opportunities and deliver training to 600 excluded young people nationally. The model is different from most SIB contracts: After a year of testing the structure, the model is being refined and scaled up, and from years two to four the SIB will include two further service providers, and an additional two investors (see details in Table 1). The original investors will recycle their capital from year one into the second phase, as well as increase their investment. Capital recycling has been used in a limited number of impact bonds, but this practice has the advantage of requiring a smaller amount of investment upfront.

The SIB project is built around two problems specific to the employment sector in South Africa, explains Lerato Lehoko, Managing Director of Bonds4Jobs, an outcome-based financing platform that serves as the financial intermediary for the SIB: First, that the existing routes into potential “growth sectors” of the economy, such as technology, tend to be lengthy and exclude young people who face financial barriers to gaining the necessary skills. Harambee Youth Employment Accelerator, the technical intermediary, has developed alternative pathways into these sectors that are potentially more cost effective and less exclusionary than traditional routes. The second challenge relates to the funding landscape: While an estimated R200 billion ($14 billion) flows annually toward postsecondary education and skilling from both the public and the private sectors in South Africa, the traditional higher education and university pathways were not responding to market demand, meaning that young people were not being adequately trained for the available opportunities. The impact bond has the potential to focus financing on results, paying for young people placed in jobs, rather than for training.

HOW DOES THIS IMPACT BOND WORK?

This SIB combines outcome payments from government funders, as well as philanthropic donors, so while it’s called an SIB, the contract is more accurately a hybrid: It combines financing from domestic government outcome funders and third-party organizations, a format also used for the Colombia Workforce SIB—the first in a middle-income country.

For the two government outcome funders, the structure offered a variety of potential benefits, such as innovation, increased efficiency, and the alignment of interests between different stakeholders. Within the employment sector, where it can be challenging for government to identify future labor market demands, the model also offered an opportunity to engage directly with the private sector, harnessing understanding of the market, as well as sharing the risk. Since both government funders had previously worked with Harambee Youth Employment Accelerator, the model provided an opportunity to test the financing structure with a trusted partner. This also meant that they had a good idea of how to price the different activities which would be combined to achieve employment outcomes.

Between April and December 2018, Harambee placed 600 young people— 61 percent of them women—in jobs across the country. The second phase of investment began on July 1, 2019, and over the next three years, the SIB aims to find employment for a further 5,400 young people. Outcomes are tracked, and interest payments made to investors on a quarterly basis, while the principal will only be paid at the end of the contract in June 2022. If outcomes are not met, investors are not repaid, and funds from the outcome funders will be used for Harambee’s next performance cycle.

LESSONS LEARNED

One of the main learnings from our study of the impact bonds market over the past five years is the key role of service provider capacity. To track progress toward metrics and transform this information into service delivery improvements, providers need to have capacity for real-time data collection and to manage adaptively. Rob Urquhart, executive for knowledge and research at Harambee Youth Employment Accelerator, reflects on the “natural attraction between a SIB and Harambee’s culture,” since the service provider was already focused on performance monitoring for the six years before the SIB. Harambee’s expertise in the employment ecosystem and existing network of government and employer partners were key drivers in the SIB. Sector expertise among all the partners meant that they were able to design and launch quickly with Harambee Academy in around 18 months—a quick turnaround relative to the extended timeframes often experienced in other impact bonds. However, not all service providers are ready for impact bond contracting: The SIB team has had to invest in getting other service providers ready.

The SIB offers some important lessons to the wider outcomes-based financing field. First, stakeholders need to clearly understand the problem they are trying to solve, and only then identify the most appropriate financial tool to pay for it. Second, working closely with experienced service providers can add clarity and direction throughout the process. In this case, the experienced service provider is now working to build the capacity of other organizations in the field. Finally, the model offers space for learning and adaptation: After a first year to test the structure, the stakeholders can reflect on lessons learned before contracting the final three years of the SIB.

This article originally appeared on www.brookings.edu on 12 July 2019 under the title “First social impact bond in South Africa shows promise for addressing youth unemployment” written by Izzy Boggild-Jones and Emily Gustafsson-Wright.

Stay Connected

Stay Connected