SA Youth connects young people to work and employers to a pool of entry level talent.

Are you a work-seeker?

The South African government recently released the first, draft Country Investment Strategy which seeks to attract and facilitate direct and foreign investment in order to drive economic growth, increase employment, and reduce poverty and inequality. The strategy identifies priority sectors which are recognised for their growth potential and potential for accelerating contributions to South Africa’s Gross Domestic Product (GDP.) To realise these gains, the strategy sets out to support investment in the prioritised sectors by:

The strategy uses a data-driven model based on several inputs to determine which sectors should be prioritised to drive investment and economic development, so there isn’t a single variable that decides which sectors to prioritise.

Economic development considerations include the extent of the sectors’ value add to GDP and job creation. Market trends and demand considers sector performance and prospective investment opportunities. Location considers the extent to which areas comparatively offer more attractive investment opportunities for investors, and how investment can be used to address existing imbalances of economic development. These three factors together with government’s policy priorities and very specifically identified strategic investment opportunities (also known as South Africa’s 5 Big Frontiers) have been integrated to prioritize sectors for investment and development.

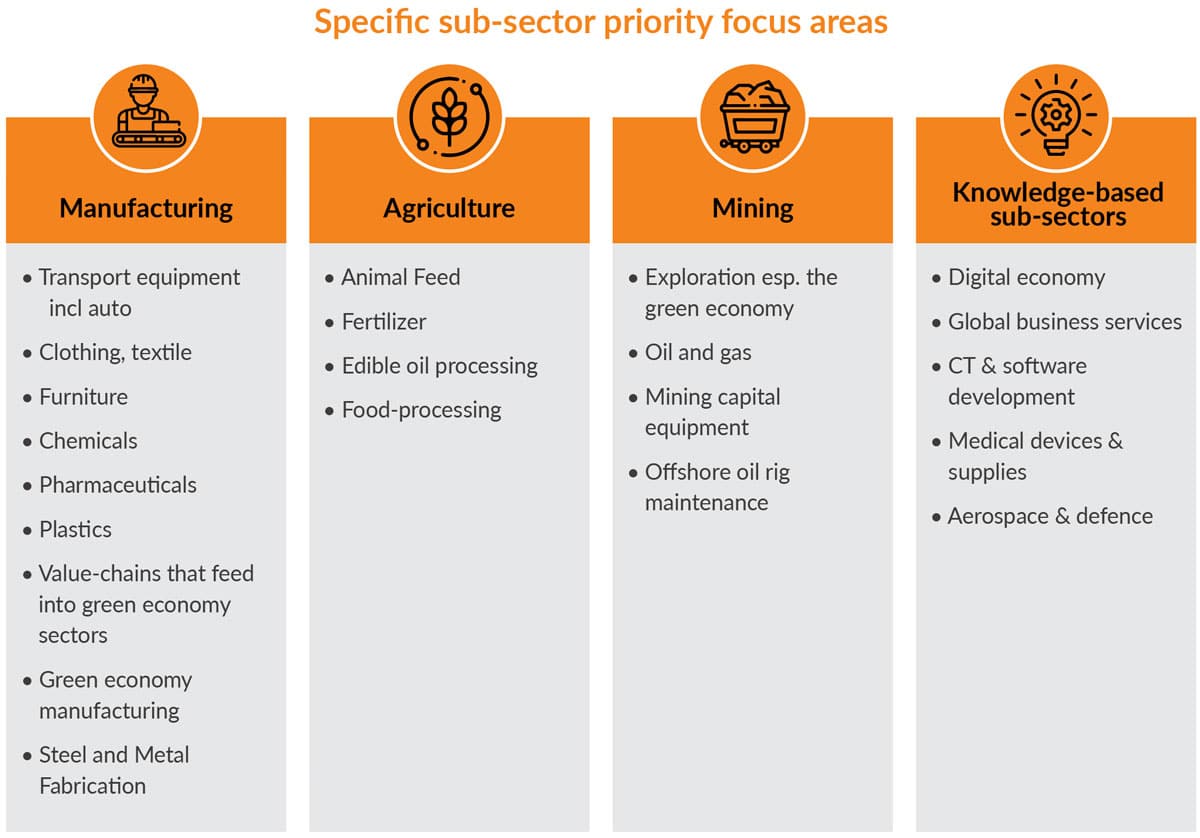

The country’s prioritised sectors to drive investment and economic development include finance, insurance, real estate and business services; transport and logistics; manufacturing; mining and quarrying; electricity, gas and water; and agriculture and agri-processing. Harambee’s focus areas for catalyzing youth employment aligns mostly with these priorities. The digital economy and global business services fall in the finance and business services sector; automotive falls in the manufacturing sector; and installation, repair, and maintenance is cross cutting. This alignment presents an opportunity to maximize impact for youth employment creation by coordinating with stakeholders in the investment and development ecosystem, linking work to policy priorities, and collaborating to strengthen capacity.

Figure 1: Specific sub-sector priority focus areas

Source: Draft South Africa Country Investment Strategy 2022

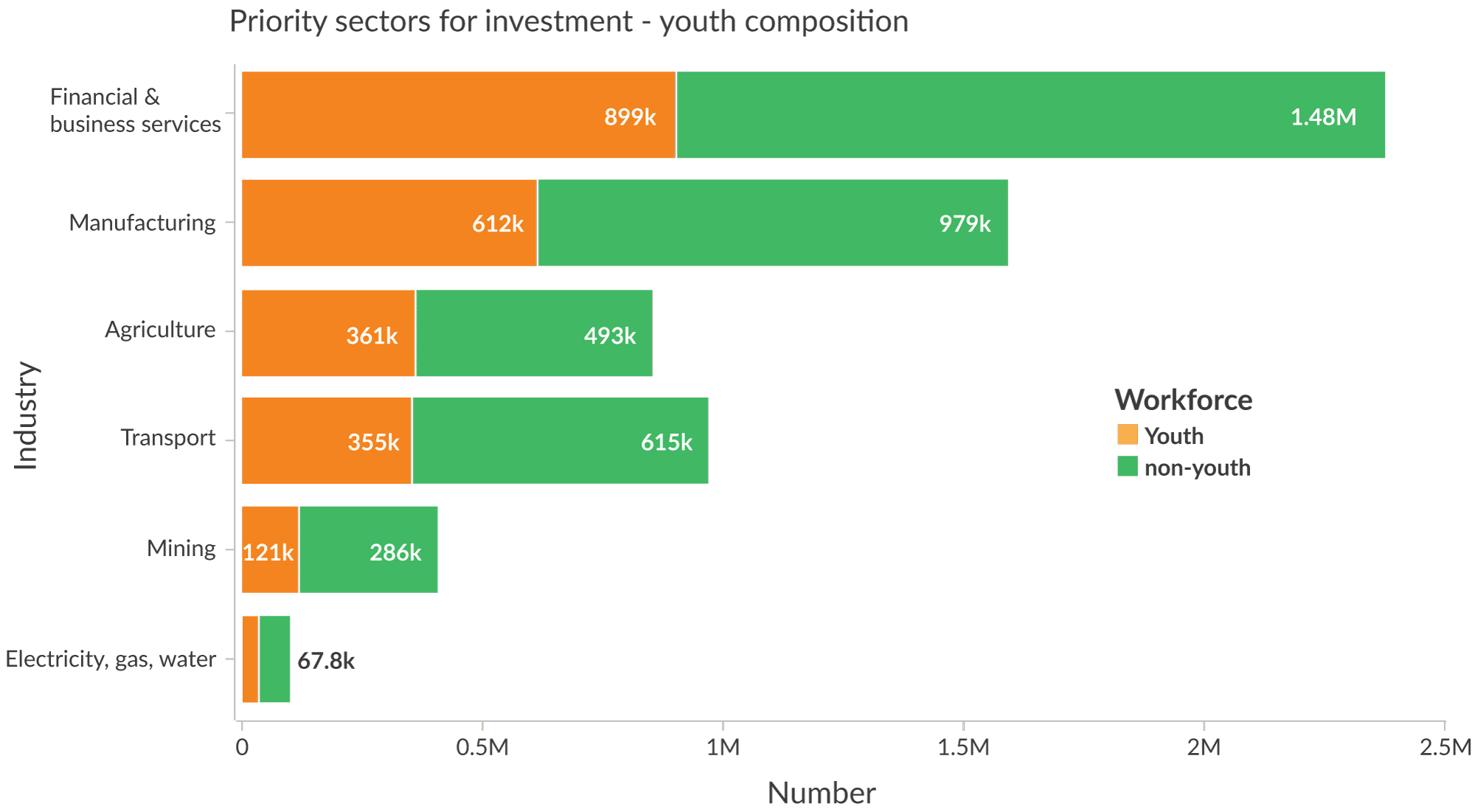

Although finance, insurance, real estate and business services account for the most employment for youth and non-youth alike, proportionately its youth absorption rate is not the highest. Agriculture has the highest youth absorption rate (42%) followed by manufacturing (38.5%.) Whilst the Country Investment Strategy represents an opportunity for alignment and increased impact with other growth and job creation initiatives, there is a need to ensure that the resultant economic growth is inclusive of youth.

Figure 2: Specific sub-sector priority focus areas

Source: Statistics South Africa, Quarterly Labour Force Survey, Q1 2022

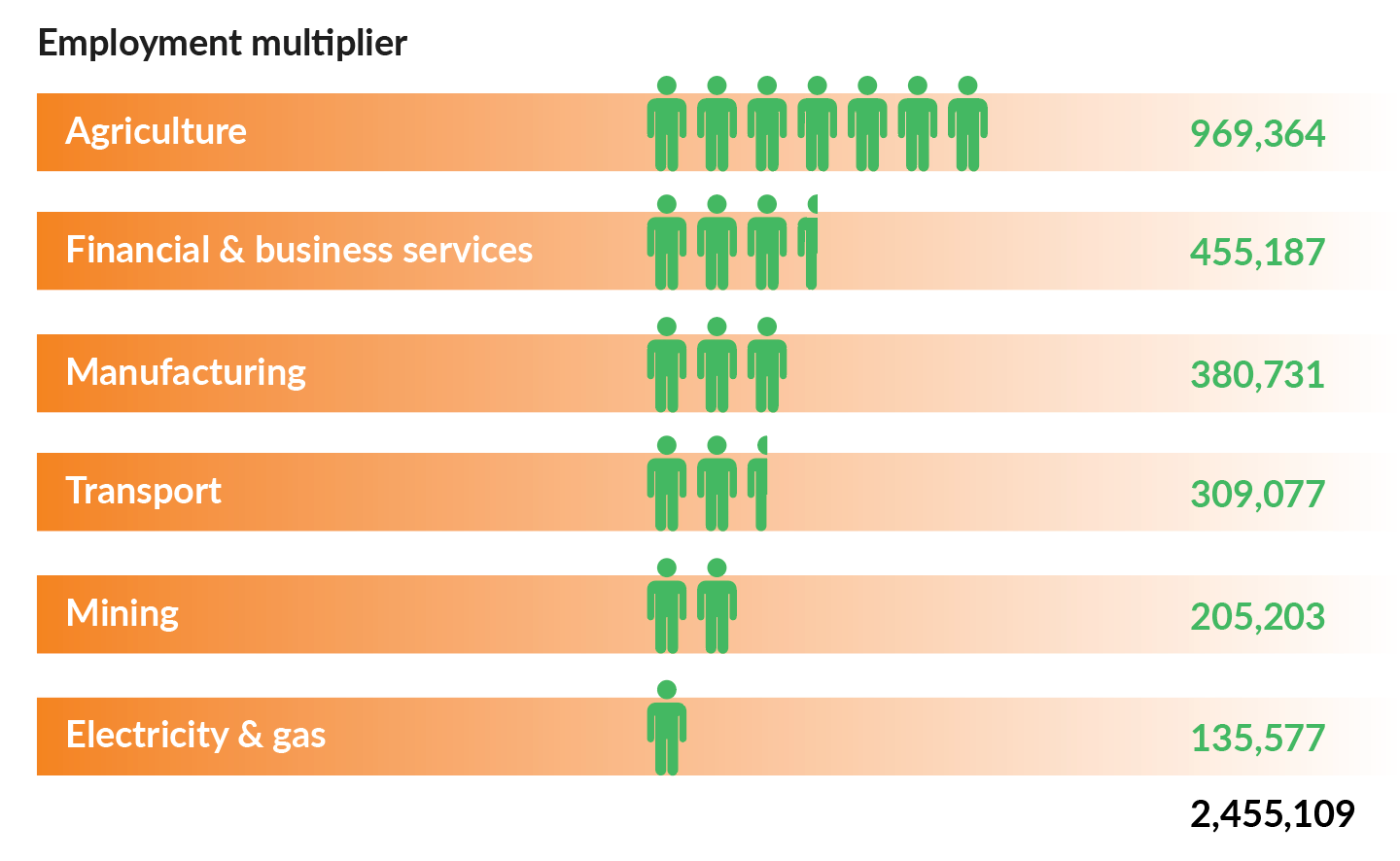

The prioritised sectors have different employment multipliers making some more attractive to employment creation. Agriculture has the highest economic multiplier1 adding 7 direct and indirect jobs in other sectors when 1 agricultural job is created, whilst financial and business services have an employment multiplier of 3.4. The Country Investment Strategy suggests that if the country were to achieve the desired level of investment of 30%2 (amounting to R600 billion) as targeted in the National Development Plan, this would significantly boost employment. When the youth labour absorption rates for different sectors is considered in terms of the potential number of direct jobs that could be created, nearly 2.5 million youth jobs could be created through the achievement of the country’s investment strategy.

Figure 3: Employment multipliers and their impact on job creation

Source: Draft South Africa Country Investment Strategy 2022

1Employment multipliers indicate the number of additional direct and indirect jobs that are created in the economy when 1 additional job is added in the sector.

2Currently below 20%.

Figure 4: Overview of the community, social and personal services sector

Source: Harambee Youth Employment Accelerator, 2022

The community, social, and personal services sector (in which the care economy is located) was the lowest ranked as a priority for direct and foreign investment with low levels of capital spending and high degree of informality as contributing factors. However, the sector should not be disregarded as a priority for youth employment: it currently employers 3,580,489 people, has a youth absorption rate of approximately 35%, and has an employment multiplier of 7.15 (direct and indirect jobs.) Direct and foreign investment may not be immediate levers to unlock youth employment here, but doubling down on the following actions3 might:

Complementing the sector prioritisation for investment, the government has also identified five specific strategic investment programmes and supporting enabling activities. These have been selected based on the government’s ability to play a role in convening, co-investing, catalyzing, and enabling investment and represent tangible opportunities for participation by other stakeholders in developing an inclusive and growing economy.

Figure 5: Unlocking the 5 frontiers of strategic investment opportunities